Q2 FY25 - Result season is over now. Most of the sectors & associated companies posted weak numbers and unable to beat the estimates in Q2. Most of the sectors posted muted revenue growth and decline in both profit & margins. Demand environments remain challenging. GDP growth during July-Sept 2024 has slowed to 5.4% which is much lower than estimates.

We have seen weak performance in Q1 & Q2 because of 2 main reasons, weak domestic demand and less government capex spend on backdrop of Lok Sabha election.

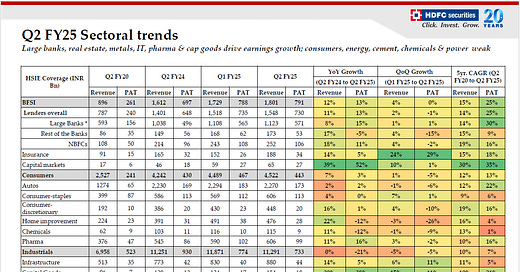

Banking sector showed decent performance. NBFC & Microfinance sector is going through headwinds and stress is clearly visible in this sector. Capital market, Hospital and Pharma sector performed well. Rest of the sector posted weak numbers.

We are in bull market from last 3-4 years now and this has resulted into overvaluation in many pockets of the market. In Q1 and Q2, most of the companies were unable to deliver good/decent numbers and justify those valuations.

Due to huge selloff from FII, we saw almost 10-12% corrections in most of the indices and post maharashtra election result, it recovered somewhat. This kind of correction is pretty normal and can happen anytime.

Indian market were already trading at high Valuations and then we had very weak Q2FY25. This was the perfect situation to witness some correction and in last 1-2 months, we have seen some correction in most of the sectors.

High Valuation + Poor Earnings Growth = Get ready for Correction or Consolidation

Continuous bull market has developed many bad habits and unreasonable expectations in investors. As per current market environment, we should temper down our expectations, Keep behaviour in control and increase patience.

Please find below graph prepared by HDFC securities for all the sectors & their performance in Q2FY25.

Ray of Hope :

1) Government Capex -

Because of Lok Sabha and state elections, many companies reported that orders are shifted from Q1 & Q2 to Q3 & Q4 quarter. Now, we have stable government in Centre and Maharashtra election is also over with same government in power, we should be able to see recovery in earnings for government capex related sectors.

For FY24-25, government planned 11.1 trillion rupees capex Out of which Government only spent 4.15 trillion in first two quarter and expected spending in remaining two quarters is 6.9 trillion. It is almost 1.16 trillion per month Capex spends. If everything goes as expected, we might see sudden jump in earnings of companies related to government Capex and which can help many sectors to post good numbers in next 2 quarters. We need to see how things pan out in next 2 quarters and how much government can spend in next 2 quarters.

Also, Indian rating agency highlighted that "The FY25 capex growth has been impacted by the general elections in May 2024, and capex in 1H FY25 shrank 15.42 per cent year-on-year. To achieve the FY25 (BE) target, capex in 2H FY25 must grow 52.04 per cent, which appears to be a daunting task”.

2) Wedding Season -

According to CAIT, 48 lakhs weddings are planned between Nov-Dec 24. Indian Wedding Industry has potential to move so many sectors like Jewellery, Hotel, Apparel, Aviation and many more. This wedding season might add some growth in Q3.

3) Festival Season -

Diwali and other festive seasons might have added some growth in Q3.

4) Interest Rate Cut -

Across the world, interest rate easing cycle is started excluding India. RBI and MPC has refused to ease policy or push in liquidity into the system. Sooner or later RBI needs to start cutting interest rate to support economic growth.

What We Can Do :

1) Have reasonable expectations & increase time horizon for investing.

Someone asked me "Who hurt you?"

I replied "My own expectations" - Unknown

2) Know What You Own - Understand reason behind stocks you are buying because when volatility increases its your own conviction that saves you from making terrible decision.

3) Look for sector & stocks where valuation is reasonable & growth prospects are good.

4) Don't chase random breakout stocks. Understand the fundamental trigger behind breakout and then take a decision. This is not a market where you can pick any stock, draw some lines, and make money. Try to find fundamental trigger behind it.

5) Read more businesses concall and try to find industry insights & growth prospects.

6) Look for sector witnessing tailwinds and try to position portfolio around those sectors. Also, if you want to buy stocks at cheap prices (which mostly happen when sector is going through headwind) then try to ensure that overall portfolio size of stocks facing headwinds should not be more than 20-30% and whenever you will get Fundamental or Technical confirmation then you can increase the position. We make most of the mistakes in investing when we try to find perfect bottom prices.

Let’s hope, next two quarter will come up with some good numbers & till that time, have reasonable expectations, have some patience and try to find stocks where sector tailwinds are visible & stocks are available at reasonable valuations.

Sector Tailwind + Growth + Reasonable Starting Valuation + Fundamental Catalyst + PATIENCE OR Sector Headwind + Decent Growth + Extremely Cheap Valuation + Fundamental Catalyst + LOT OF PATIENCE = Long Term Investing Journey !!!

Disclosure: I am not SEBI registered. The information provided here is for education purpose only. Hence, always check with your financial advisor before acting on any contents of this newsletter.

Very good explanation current market conditions, keep it up

Your blog is impressive and insightful. Your ability to break down complex current market situation into easily understandable concepts is a true talent. I particularly appreciate your formula of 'sectors with tailwind require patience and sectors with headwind require a lot of patience.' I look forward to reading more of your insightful write-ups