As highlighted in Q2 FY25 review newsletter, we were trading at high valuation and growth slowed down & that triggered huge selloff in the market. In last 3-4 months, we are seeing huge selloff from FII and most of the indices are down significantly.

Q3 FY25 - Result season is over now. Most of the sectors & associated companies showed decent numbers compared to Q2. Demand environments remain challenging. GDP growth has improved from 5.4% in Q2 to 6.2% in Q3 which is aligned with estimates.

Banking, Pharma, Hospitals, Insurance, Telecom, Consumer Discretionary & Aviation sector showed decent performance. NBFC & Microfinance sector is still going through headwinds. Capital market sector showed weak performance due to its direct dependency on market performance. Rest of the sectors posted weak numbers.

Please find below graph prepared by HDFC securities for all the sectors & their performance in Q3 FY25.

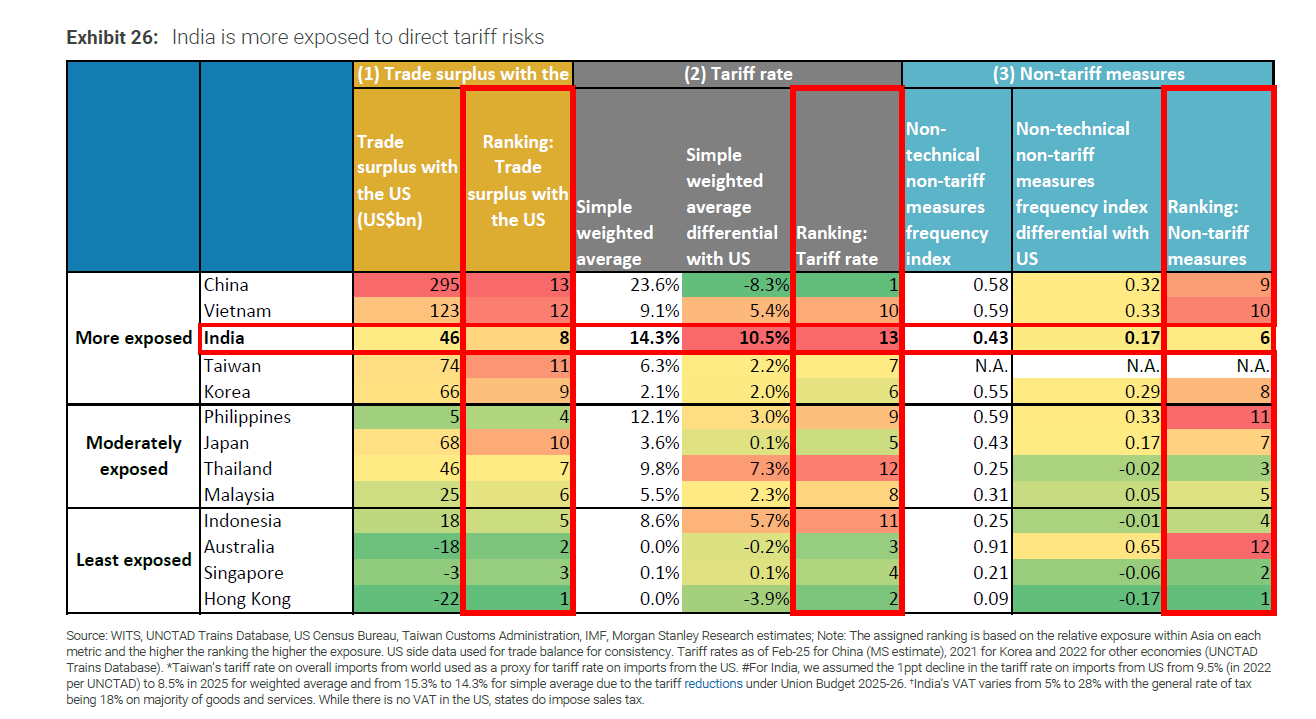

The Biggest Risk - Trump Tariffs :

Under Trump government, The only certainty is Uncertainty.

Trump administration is frequently announcing new tariffs on various countries & creating environment where businesses and investors could not predict future trade policies. This uncertainty made it difficult for companies to plan long-term strategies.

Tariffs imposed by the Trump administration affected not just the US but also economies worldwide. Countries targeted by tariffs often retaliated leading to trade wars that disrupted international trade and economic growth.

Finding Light in Chaos :

As internet is already filled with so many negative news around indian stock market, I will not add more noise there so lets focus on Positives :)

Income Tax Reform :

Finance Minister had announced an income tax reform which will allow zero income tax for those earning up to ₹12 lakh. This will leave more money in the hands of the middle class & hopefully improve consumption growth.Finally Interest Rate Cut Started:

RBI has cut interest rates by 25 basis points for the first time in last five years to counter slowing growth & improve economic growth. It looks like, there will be more rate cuts in coming quarters.RBI Liquidity Injection :

RBI said it will infuse $21 billion in rupee liquidity into the banking system in a bid to ease lending conditions and boost economic growth.

India central bank announces over $21 billion liquidity infusion to support growthGST Rate cut soon :

Finance minister said GST rate cut soon & tax review in final stages. This will provide much needed boost to economic growth.

CPI Inflation going down & IIP growth rebound :

Consumer Price Index-based inflation (CPI) moderated to 3.61% in February from 4.26% in January.

Industrial production growth (IIP) rebounded to 5% in January 2025, after slowing to 3.5% in December.Crude, Dollar & bond yields Falling:

In the past 2-3 weeks, crude oil prices, US dollar and bond yields have begun to decline. If these trends of falling crude oil prices, stronger Indian Rupee, declining Dollar Index and stable U.S. Treasury yields persist, it will likely be broadly favorable for emerging markets like India.Low Base Effect start kicking from Q1 FY26 :

Due to the elections & less government spending last year, many companies reported weak numbers in Q1 and Q2 of last year, creating a low base. As a result, even if there is a reasonable improvement in FY26, the numbers will appear strong in comparison to the low base from last year.

Government & RBI taking necessary actions to bring back growth + Crude, Dollar & bond yields are Falling + Inflation going down & IIP going up + Valuation getting reasonable post correction = Good time to focus on opportunitiesLet's remain hopeful that the next 2-3 quarters will yield positive outcomes, Trump will tweet less about Tariffs and measures taken by the government and RBI will successfully revive economic growth.

I am not expecting V shaped recovery but most likely it will be W shaped recovery with slow & steady pace. After the significant decline over the past few months, I feel we are entering into Time correction phase now. This is the phase where BASE FORMATION starts & market prepare itself to introduce new winners.

In the meantime, keep reasonable expectations, build tons of PATIENCE and keep the bigger picture in mind.

Disclosure: I am not SEBI registered. The information provided here is for education purpose only. Hence, always check with your financial advisor before acting on any contents of this newsletter.

Excellent analysis!!!

Would suggest not referring to any Brokerage house as that can be detrimental for your publication having no copyrights