Q4 FY25 Review & The Bright Side

I began writing quarterly result reviews starting from Q2 FY25. Below were the titles of those newsletters.

And here we are with 3rd quarterly review with the title as “Q4 FY25 & The Bright Side”

Last quarter, there was no shortage of negative news across the world. Since Trump came into power, war has become a very common topic. Every now and then a new conflict seems to erupt somewhere in the world. First everything started with Tariff war started by US on all the countries & then we had India Pak war, Israel Palestine war & Israel Iran war with US bombing Iran’s Nuclear Facilities. After all this someone somewhere hoping that he will get nobel prize for peace.

The internet is and likely always will be filled with more negative news than positive. Anyway, you will see plenty of negative news in WhatsApp groups and Twitter feeds.

I always try to focus on the bright side because when whole world is super Pessimistic then its worth to be little more Optimistic.!!!

I tried to highlight the same in 1st march newsletter called Deja Vu !!! Refer below screenshot for conclusion of that newsletter.

Last line of that newsletter was -

After 6-12 months from here, we will be discussing more about lost opportunities. :)

When whole world is super Pessimistic then its worth to be little more Optimistic.!!!

AND here we are just after 4 months :)

Nifty 50 is just -2.5% away from ATH

Nifty Midcap 100 is just -2.5% away from ATH

Nifty SmallCap 100 is just -3.7% away from ATH

Today, AI can analyze businesses & their balance sheets and macro data in seconds but the most powerful edge for investors still lies in self-discipline and emotional control.

Behaviour Intelligence > High IQ

Q4 FY25 - Result season is over. Most of the sectors & associated companies showed decent numbers compared to Q3. GDP growth has improved from 5.4% in Q2 to 6.2% in Q3 to 7.4% in Q4 which significantly beating analyst expectations.

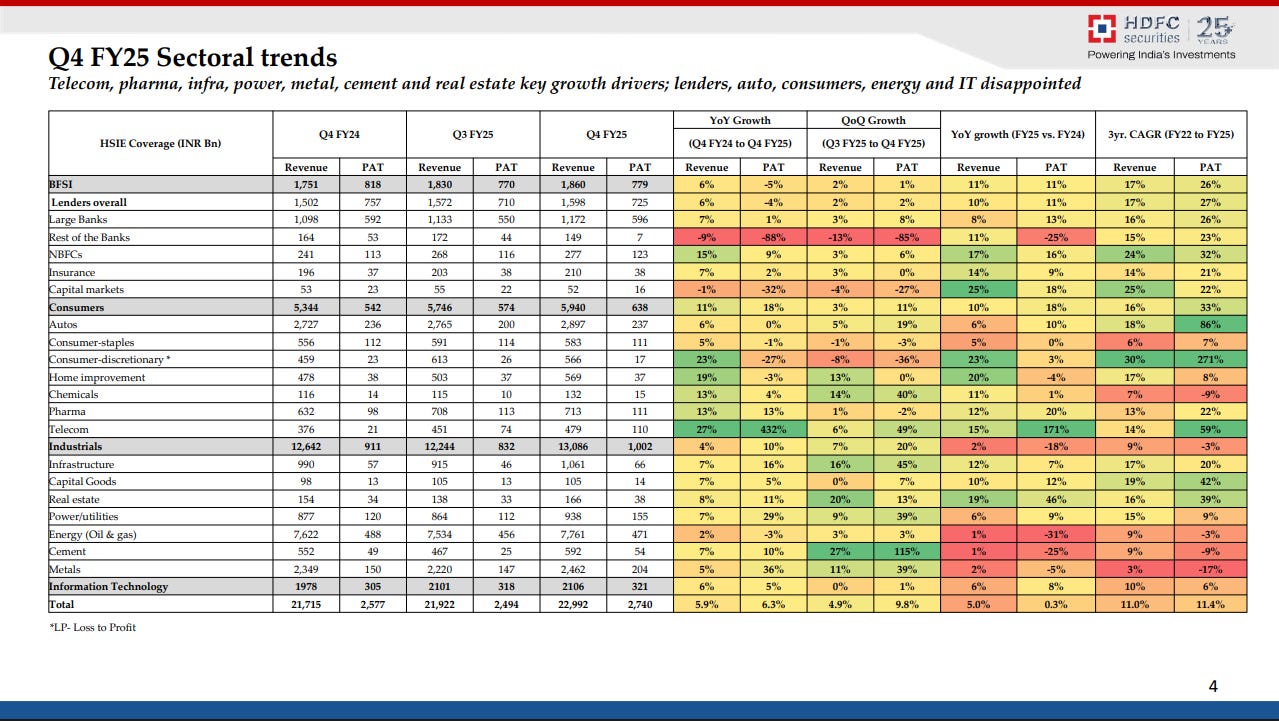

Banking, Pharma, Hospitals, Telecom, Infra, Power & Aviation sector showed decent performance. Following the interest rate cut, Banking and NBFC sectors are well-positioned. Infrastructure projects are gaining momentum. With the improvement in market texture & lineup of upcoming IPOs, capital market players are expected to report strong performance in the coming quarters.

Please find below graph prepared by HDFC securities for all the sectors & their performance in Q4 FY25.

I recommend subscribing to the SOIC Substack page. They have started sharing insightful commentary from company concalls that’s quite valuable.

So let’s focus on some positive things happened in last quarter.

Bold Move - RBI Rate Cut & CRR Cut :

The RBI has been doing exceptional work over the past few years & managing economy effectively. RBI announced a significant 50 basis points cut in repo rate, reducing it from 6% to 5.5%. This marks the 3rd consecutive rate reduction in 2025 totaling a 100 basis points decrease since February. Additionally, RBI lowered the CRR by 100 basis points. RBI is infusing good amount of liquidity into system from last few months which will support economic growth. Government & RBI taking necessary actions to bring back growth.

GDP Growth & Inflation :

India's economy grew by 7.4% in the period between January and March up from 6.2% the previous quarter and significantly beating analyst expectations. At the same time, Inflation is under control which is a good sign.

Decent Performance from Mid & Small Cap companies :

This quarter, most of the Mid & Small cap companies showed decent performance despite of having last year high base. Once again, Large cap companies were not able to show good performance. To witness strong bull market ahead, Indian companies needs to show strong earnings growth across the board. Right now, Earnings growth is coming in specific pockets.Impressive Recovery in PMI data:

India's economic activity reached a 14-month high in June 2025, driven by strong PMI data. Companies boosted output due to increased new business and export orders.Crude, Dollar & Bond yields :

Crude oil prices, US dollar, and bond yields have declined over the past few months. If these trends of falling crude oil prices, stronger Indian Rupee, declining Dollar Index and stable U.S. Treasury yields persist, it will likely be broadly favorable for emerging markets like India.FIIs are Back :

Few months back, biggest trigger for selling across the indian market was big FII selloff. From March, we are seeing FII buying coming back in Indian market.

Private Sector Capex Picking UP :

Over the past 2–3 years, the government has been the primary driver of capital expenditure. However, there are signs of a revival in private sector capex as well. Hopefully, this trend will gain momentum in the coming quarters and contribute significantly to economic growth.Low Base Effect start kicking from Q1 FY 26 :

Due to the elections & less government spending last year, many companies reported weak numbers in Q1 and Q2 of last year, creating a low base. As a result, even if there is a reasonable improvement in FY26, the numbers will appear strong in comparison to the low base from last year.In last 2-3 months, market is back in momentum and many stocks started flying but fundamental momentum is still missing in many companies. To have strong bull market & broad based rally, we need strong earnings growth across the board. Hopefully, the factors mentioned above will begin to show positive results in the coming quarters. On the global front, the anticipated India US trade deal is expected to be signed soon which could bring greater clarity and confidence to businesses operating across borders.

In the meantime, investors should focus on sectors and companies showing solid earnings momentum.

Stay optimistic, stay focused and always keep the bigger picture in mind. :)

Sector Tailwind + Growth + Reasonable Starting Valuation + Fundamental Catalyst + Technical strength + PATIENCE OR Sector Headwind + Decent Growth + Extremely Cheap Valuation + Fundamental Catalyst + LOT OF PATIENCE = Long Term Investing Journey !!!

Disclosure: I am not SEBI registered. The information provided here is for education purpose only. Hence, always check with your financial advisor before acting on any contents of this newsletter.